The 10-second answer

If your Ontario staff are engaged through a reputable Employer of Record (EOR), the EOR is the legal employer and is typically responsible for registering with WSIB, adding your workers to its account, paying premiums, and handling claims. You generally don’t open your own WSIB account for those EOR-payrolled workers. The exceptions are when you also employ people directly (outside the EOR), operate in an industry with special rules (e.g., construction owners/officers), or you need optional coverage for people not on the EOR’s payroll.

First things first: what WSIB is (and why it matters)

The Workplace Safety & Insurance Board (WSIB) is Ontario’s no-fault workers’ compensation system. Eligible workplace injuries/illnesses are covered for medical care and wage loss, and in exchange, employers are shielded from most lawsuits related to those injuries. For many employers, WSIB registration is mandatory and must be done within 10 calendar days of hiring the first employee in Ontario. Coverage status depends on your business activities; some industries are exempt from mandatory registration but may opt-in for coverage.

WSIB premiums are paid by employers, not workers. Ontario sets a class-based rate (shared risk within your industry) and adjusts for your firm’s experience (claims history). The average premium rate for 2025 is $1.25 per $100 of insurable payroll (lowest in 50+ years).

What an Employer of Record actually does (in Ontario context)

An EOR hires your people on paper (legal employer), while you direct the day-to-day work. The EOR runs payroll, withholds taxes, provides statutory benefits, and ensures compliance with provincial rules where the worker sits—here, Ontario. As part of that compliance, reputable EORs register workers for WSIB, remit premiums, and manage claims and return-to-work coordination. For multi-province teams, they also register in the correct provincial board (e.g., WorkSafeBC, CNESST), and pro-rate premiums when work spans jurisdictions.

Bottom line: When your staff are on the EOR’s payroll in Ontario, the EOR owns the WSIB account and obligations for those workers.

Who registers and who pays?

- EOR-payrolled staff in Ontario: The EOR registers with WSIB (if not already), adds those workers to its WSIB account, and pays premiums based on your workers’ classification(s). You reimburse this cost via the EOR invoice.

- Your direct hires (outside the EOR): If you employ anyone directly in Ontario in a covered activity, you must register and pay premiums for those people—even if other workers are on the EOR.

- Optional coverage cases: Businesses not required to register may choose to opt-in for employees (and then themselves) to get WSIB protection; in construction, coverage is broadly mandatory (including many owners/executives).

Why this matters: If you’ve moved everyone onto an EOR, you can often inactivate or close your own WSIB account to avoid zero-filing. If you keep a mixed model (some on EOR, some direct), you’ll maintain your account and only report/pay for the direct group.

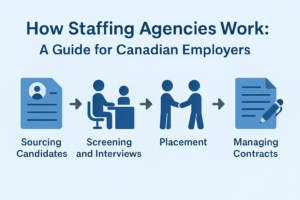

How claims work when you’re using an EOR

If a worker is injured or becomes ill due to work:

- Immediate steps at the site: Provide first aid, arrange care, and notify the EOR.

- Employer report timing: Ontario requires the Employer’s Report of Injury (Form 7) be filed within three business days once the employer learns they must report (e.g., health-care treatment, lost time, or modified duties beyond the threshold). With an EOR, they file the Form 7 because they are the employer of record.

- WSIB benefits & RTW: WSIB adjudicates the claim, pays approved wage-loss/medical benefits, and supports return-to-work. The EOR coordinates with WSIB and you on modified duties.

Legal protection: Since WSIB is a no-fault system, covered workers typically cannot sue their employer for the injury. Your EOR’s WSIB coverage extends that protection to your worksite as well.

Costs: what to expect (and control)

- Rate mechanics: Your cost is driven by the WSIB class (industry risk) and claims experience. The average 2025 rate is $1.25 per $100 payroll; your EOR’s invoice will reflect the appropriate rate(s) plus its admin fee.

- Classification accuracy: Tell your EOR exactly what work is performed so they assign the correct class. Wrong classes can mean incorrect premiums and potential re-assessments.

- Prevention saves money: Fewer injuries → better experience rating → lower costs passed through your EOR. (Also fewer disruptions to your operations.)

Real-world scenario (Ontario)

A Cambridge manufacturer needs six skilled operators on short notice. Rather than set up/learn WSIB processes, they partner with an EOR. The EOR onboards all six operators under its Ontario WSIB account and starts billing the client the class rate for that risk category. Three months in, one worker has a minor injury needing medical attention and modified duties for eight days. The EOR:

- Files Form 7 within the three-business-day window,

- Coordinates modified duties with the client (you),

- Manages the claim until the employee returns to full duty.

The client never touches WSIB forms, never risks a late-reporting penalty, and the worker gets timely benefits.

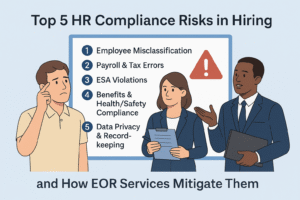

When you still might need your own WSIB

Even with an EOR, you may still need your own WSIB account if:

- You have any direct hires in Ontario in covered activities (e.g., office admin you kept in-house, a site supervisor on your payroll).

- You’re in construction and subject to expanded compulsory coverage for certain owners/executives who aren’t on the EOR’s payroll.

- You want optional coverage for people not on the EOR (e.g., founders who want WSIB for themselves).

Mixed models are fine—just be crystal-clear who is covered by whose account. The EOR handles its employees; you handle yours.

Cross-border and multi-province teams

If your people work across provinces, Canada’s boards use Interjurisdictional Agreements (IJA) so premiums flow to the province where the work is performed. A proper EOR registers and reports in the right board(s), and pro-rates earnings when work spans jurisdictions. This keeps you compliant if, say, a rep spends time in Ontario and Quebec in the same quarter.

Compliance, penalties, and peace of mind

Missed registrations or late reporting can trigger retroactive premiums, interest, penalties, and potential prosecution. An EOR’s value is doing the right things on time (registering, reporting, remitting) so you avoid that risk. If you shift to 100% EOR, consider closing or inactivating your own WSIB account to reduce admin—but only if you won’t have direct hires in a covered activity.

How to choose an EOR (WSIB checklist)

- Proof of coverage: Ask for a WSIB clearance or account details showing they’re in good standing in Ontario.

- Classification knowledge: Confirm they’ll classify your roles correctly and explain the rate on your invoice.

- Claims process: Have them walk you through Form 7 timing and return-to-work coordination.

- Multi-province readiness: If relevant, confirm they manage IJA reporting across provinces.

- Contract language: Ensure indemnities and responsibilities around safety, reporting, and cooperation are clear.

Divino’s take (and fit)

If you’re a small or mid-sized Ontario employer, the fastest, lowest-risk way to stand up a compliant team is often an EOR. You get speed to hire, predictable costs, and WSIB done right—with none of the forms on your desk. For manufacturers, logistics, tech, field services, and seasonal operations, that can be the difference between missing and making a growth window. Divino’s local support model means your workers get timely help and your job sites have a partner tuned to Ontario realities.

Practical do’s and don’ts

- Do notify the EOR immediately when an incident occurs; the three-business-day clock is real. wsib.ca

- Do keep great documentation (modified duties, training, equipment sign-offs).

- Don’t assume EOR coverage extends to anyone not on their payroll.

- Do ask the EOR to review your job hazard profiles so they align the WSIB class correctly. wsib.ca

- Don’t wait to clarify who files what; agree on the reporting workflow in onboarding.

Conclusion

If you use a reputable Employer of Record for your Ontario team, they take care of WSIB—registration, premiums, and claims—for the people on their payroll. You generally don’t need your own WSIB coverage for those workers. You do still need coverage for anyone you employ directly, and you may opt-in for additional protection when you’re exempt. Keep safety front-and-center, verify the EOR’s coverage and process, and you’ll be protected, compliant, and free to focus on growth. Check out how to simplify recruitment or The Bias of Interviews: Are You Just Hiring a Smile?

FAQs

Q1) If all my Ontario workers are on an EOR, do I still register with WSIB?

If everyone is on the EOR’s payroll, you typically don’t open your own WSIB account. If you employ anyone directly in a covered activity, you still need your own account for those people. wsib.ca

Q2) Who actually pays the WSIB premiums in an EOR setup?

The EOR pays WSIB and bills you back. The rate is class-based with experience adjustments; Ontario’s average for 2025 is $1.25 per $100 of insurable payroll. wsib.ca+1

Q3) A worker got medical treatment and is on modified duties—who files Form 7?

The EOR, as legal employer, files Form 7 within three business days of the reporting trigger. You support with facts and modified duties as needed. wsib.ca

Q4) We’re a tech firm and heard WSIB might be optional—should we still get coverage?

Some industries are not required to register, but many firms opt-in for protection and client requirements (e.g., on-site work). If you’re using an EOR, they typically cover workers regardless, as part of compliance. wsib.ca+1

Q5) We operate in multiple provinces—how do premiums work?

Canada’s boards use interjurisdictional rules so each province collects premiums for work performed there. A solid EOR handles registrations and pro-rates insurable earnings across provinces. wsib.ca

Q6) Does WSIB mean employees can’t sue?

WSIB is a no-fault system that generally bars lawsuits for covered workplace injuries and channels compensation through the Board. iwh.on.ca

Q7) What happens if an employer required to register never did?

WSIB can assess retroactive premiums, interest, and penalties—and still pay the worker’s claim, then recover costs from the employer. Using an EOR properly helps avoid these risks. wsib.ca

Citations (Ontario-first, government and authoritative sources)

- WSIB – 2025 premium rates: average rate $1.25 per $100 of insurable payroll. wsib.ca

- WSIB – Registration FAQs: register within 10 days of hiring the first employee (most businesses). wsib.ca

- WSIB – Coverage status: who requires coverage; optional coverage for non-mandated industries. wsib.ca

- WSIB – Can I choose to have WSIB insurance? (optional coverage; construction rules). wsib.ca

- WSIB – Employer’s Report of Injury (Form 7) – Reference Guide: 3 business days filing window and triggers. wsib.ca

- WSIB – Report an injury or illness: modified work rule and 8th day trigger context. wsib.ca

- WSIB – Premiums and payment: class-based rating and experience. wsib.ca

- WSIB – Interjurisdictional Agreements (IJA) (premiums flow to province of work; pro-rating). wsib.ca

- WSIB – Who is an Employer? (legal responsibility to the WSIB sits with the registered employer). wsib.ca

- WSIB/HR Reporter – Employer obligations & WSIB overview (plain-English explainer). HR Reporter

- Deel – EOR in Canada (workers’ comp handled by EOR; cross-province differences). Deel