Hiring employees is one of the most exciting steps for any business. It means growth, new opportunities, and greater capacity. But with growth comes risk—especially when it comes to HR compliance. In Ontario, the landscape of employment law is complex, with obligations tied to the Employment Standards Act (ESA), the Canada Revenue Agency (CRA), and the Workplace Safety & Insurance Board (WSIB), to name a few. Add in privacy rules under PIPEDA, and suddenly, the hiring process feels like a legal minefield.

For small and mid-sized employers, compliance mistakes aren’t just paperwork errors—they can result in hefty fines, audits, and lawsuits. Even large companies with dedicated HR teams stumble. In fact, global studies show that compliance failures are among the costliest risks employers face, especially when hiring cross-border staff.

This is where an Employer of Record (EOR) becomes a game-changer. An EOR is a third-party service that becomes the legal employer of your workforce, taking on responsibility for payroll, taxes, benefits, and compliance. Essentially, they absorb the compliance burden so you can focus on running your business.

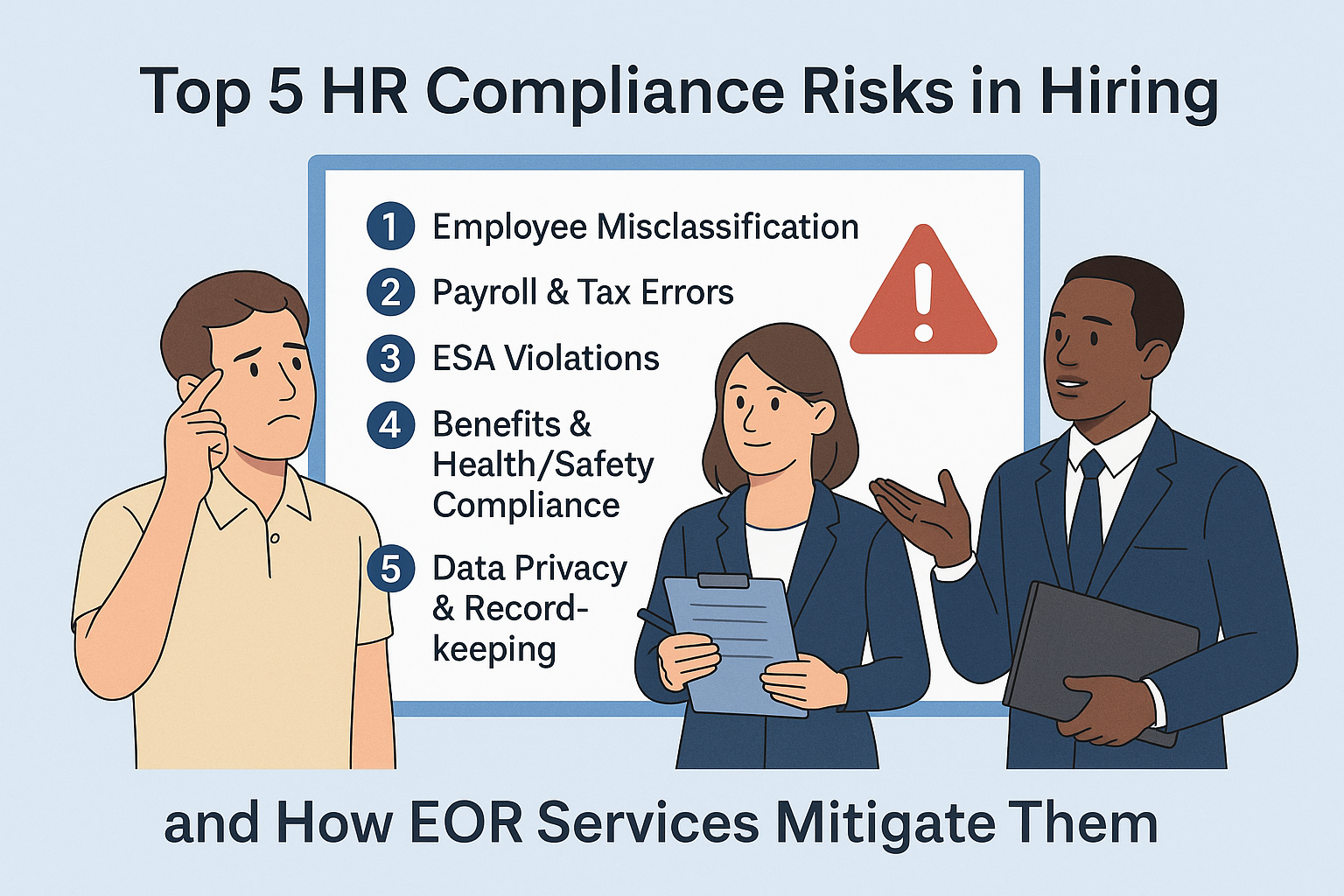

Let’s break down the top 5 HR compliance risks in hiring and see how EOR services help Ontario employers avoid these costly pitfalls.

Risk #1: Employee Misclassification

One of the most common HR mistakes is misclassifying employees. This happens when workers are treated as independent contractors when, in reality, they should be classified as employees.

Why It’s Risky

In Canada, the CRA and ESA set clear definitions for employees vs. contractors. Misclassification can mean unpaid CPP and EI contributions, missing WSIB coverage, and denial of overtime or vacation entitlements. Employers who misclassify workers can face retroactive taxes, penalties, and lawsuits.

Real-world example? Ride-sharing and delivery companies like Uber and SkipTheDishes have faced repeated legal scrutiny over whether drivers are contractors or employees. Courts have increasingly sided with workers, highlighting the risk for employers who rely too heavily on contractor models.

How EORs Solve It

An EOR takes on the legal responsibility of employing staff. They ensure that anyone on their payroll is classified correctly and gets the benefits and protections they’re entitled to. No more guessing games or worrying about the CRA showing up years later with a tax bill.

Risk #2: Payroll & Tax Errors

Payroll might seem straightforward—until it isn’t. From calculating deductions to remitting taxes, payroll compliance is one of the most time-sensitive and error-prone areas of HR.

Why It’s Risky

Payroll errors include:

- Not withholding enough CPP, EI, or income tax.

- Missing WSIB premiums.

- Late remittances to CRA.

- Miscalculating overtime or vacation pay.

CRA penalties can add up quickly: late remittances may incur penalties of up to 20% of the amount owed, plus interest. Small mistakes compound fast, leaving employers with expensive audits.

How EORs Solve It

An EOR automates payroll through their system and ensures accurate deductions, remittances, and filings. Because payroll is their core business, they stay updated on changing tax rates and remittance schedules. For employers, this means fewer sleepless nights worrying about audits and fewer surprises in the mail from CRA.

Risk #3: Employment Standards Act (ESA) Violations

The Ontario ESA governs everything from minimum wage to overtime, vacation, statutory holidays, and termination notice. Even well-meaning employers often slip up here.

Why It’s Risky

Common ESA mistakes include:

- Failing to pay overtime after 44 hours in a week.

- Not providing proper vacation pay (minimum 4% for under 5 years, 6% after).

- Overlooking rest periods between shifts.

- Mismanaging terminations and severance.

Violations can result in orders to pay wages, fines, and public naming on Ontario’s list of non-compliant employers. Reputational damage can be worse than the fine itself.

How EORs Solve It

An EOR ensures employees are managed under current ESA standards. They calculate entitlements, enforce rest and overtime rules, and structure terminations correctly. This shields employers from compliance missteps while reassuring employees that they’re treated fairly.

Risk #4: Benefits & Workplace Safety Compliance

Beyond pay, employers must handle benefits, statutory leaves, and workplace safety obligations. This is where WSIB coverage and health-related compliance come in.

Why It’s Risky

Employers who fail to register for WSIB when required face retroactive premiums, penalties, and prosecution. Similarly, not providing statutory benefits like EI, CPP, or maternity/parental leave rights can land an employer in legal hot water. Health and safety training lapses also create liability if injuries occur.

How EORs Solve It

EORs automatically provide:

- WSIB coverage in Ontario (workers are enrolled under the EOR’s WSIB account).

- Mandatory benefits (CPP, EI, statutory leaves).

- Safety reporting and claims management if injuries happen.

For employers, this means peace of mind that every worker is properly covered and no one falls through the cracks.

Risk #5: Data Privacy & Recordkeeping

HR isn’t just about people—it’s about data. Payroll info, health records, SIN numbers—all of it is sensitive and regulated under Canada’s PIPEDA privacy law and provincial equivalents.

Why It’s Risky

Improper handling of employee data can trigger investigations, fines, and lawsuits. Beyond the legal risks, data breaches erode trust with employees. In an age of rising cyber threats, employers must ensure records are secured and compliant.

How EORs Solve It

An EOR invests in secure HRIS systems that store employee data safely, meeting or exceeding PIPEDA standards. They also ensure mandatory recordkeeping periods are respected (for payroll, WSIB, ESA compliance). For a small or mid-sized business, this level of secure infrastructure would be expensive to build in-house.

How EOR Services Mitigate All 5 Risks

The true value of an EOR isn’t just in handling one task—it’s in acting as a compliance partner. Here’s how EORs mitigate the big risks across the board:

- Expertise on demand: They employ HR and legal specialists who stay on top of changing rules.

- Local compliance: Whether you hire in Ontario or across Canada, the EOR ensures each worker meets the local legal requirements.

- Predictable costs: Employers pay a single invoice that covers payroll, WSIB, taxes, and benefits.

- Speed: You can onboard workers within days, without waiting to set up CRA accounts or WSIB registration.

- Risk transfer: The EOR, as the legal employer, carries much of the compliance liability.

Divino’s Perspective

At Divino Solutions, we’ve seen firsthand how even the best-intentioned employers stumble on compliance details. A missed overtime payment, a misclassified contractor, or a forgotten WSIB registration can spiral into major costs. By using an EOR, employers can grow confidently, knowing compliance is being handled by experts who live and breathe these rules every day.

For Ontario businesses facing growth, an EOR isn’t just a convenience—it’s protection against the hidden costs of hiring mistakes.

Conclusion

HR compliance risks are real and costly, but they don’t have to slow your growth. From misclassification to payroll errors, ESA violations, benefits lapses, and data privacy concerns, each risk carries potential penalties that can derail a business.

An Employer of Record acts as a safety net—covering your workforce under proper classifications, ensuring payroll and benefits compliance, managing WSIB, and securing sensitive data. Instead of worrying about CRA audits or WSIB inspectors, you can focus on what matters: building your team and your business.

In short: EOR services don’t just make hiring easier—they make it safer. Check out how to simplify recruitment or The Bias of Interviews: Are You Just Hiring a Smile?

FAQs

Q: What is the biggest HR compliance risk in hiring?

Misclassification of employees as contractors. It can lead to retroactive taxes, unpaid benefits, and legal disputes.

Q: How does an EOR prevent misclassification?

The EOR becomes the legal employer and ensures workers are classified correctly, avoiding CRA and ESA penalties.

Q: Who handles WSIB if I use an EOR?

The EOR registers workers under its WSIB account and pays premiums, passing costs through in your invoice.

Q: Do small businesses benefit from an EOR for compliance?

Yes. Small businesses without HR teams can offload payroll, WSIB, and ESA compliance to an EOR.

Q: What penalties exist for compliance failures?

Penalties range from CRA fines and retroactive premiums to WSIB prosecution and ESA wage orders.

Here are the live links for the citations I referenced (to use as your source list):

- WSIB – Registration policy / requirements for mandatory registrants: https://www.wsib.ca/en/operational-policy-manual/registration WSIB

- WSIB – Employer obligations, classification, premiums: https://www.wsib.ca/en/operational-policy-manual/employer-obligations WSIB

- WSIB – Registering your business, optional coverage, timeline: https://www.wsib.ca/en/businesses/registration-and-coverage/register-us WSIB

- WSIB – Do you need to register, 10-day rule: https://www.wsib.ca/en/businesses/registration-and-coverage/do-you-need-register-us

- WSIB – Registration FAQs, penalties for late registration: https://www.wsib.ca/en/businesses/registration-and-coverage/registration-faqs

- CRA – Employee or self-employed guide (misclassification rules): https://www.canada.ca/en/revenue-agency/services/forms-publications/publications/rc4110/employee-self-employed.html

- HR Reporter – obligations & WSIB for Ontario employers: https://www.hrreporter.com/chrr-plus/employment-law/employer-obligations-and-wsib-what-ontario-employers-need-to-know/392332

- Office of the Privacy Commissioner – PIPEDA requirements: https://www.priv.gc.ca/en/privacy-topics/employers-and-employees/02_05_d_17/ Privacy Commissioner of Canada+1

- Dentons – contractor vs. employee in Ontario / ESA: https://www.dentons.com/en/insights/articles/2023/september/15/is-your-contractor-really-an-employee Dentons

- BDC – Registering with WSIB in Ontario timeline / who must register: https://www.bdc-canada.com/BDC/services/Ontario/WSIB_Registration.htm