The startup world moves at breakneck speed. For new companies eyeing aggressive growth – whether expanding across the U.S., into Canada, or beyond – scaling quickly is essential for survival. Yet rapid expansion brings heavy challenges. Hiring top talent in new markets means navigating foreign laws, setting up local entities, managing multi-country payroll, and avoiding compliance pitfalls. These hurdles can slow a startup’s momentum to a crawl. Fortunately, there’s a solution: the Employer of Record (EOR) model. By using an EOR, even a lean startup can hire internationally in days instead of waiting months for entity setup. In this guide, we’ll explore how startups can harness EOR services to scale fast, stay compliant, and keep their focus on innovation.

The Challenge of Rapid Scaling for Startups

Speed is a double-edged sword for growing startups. On one hand, being first to market or quickly entering new regions can be a game-changer. On the other, expanding too fast without proper infrastructure can cause operational chaos. Key scaling challenges include:

- Setting Up Legal Entities Abroad: Establishing a subsidiary in a new country is slow and costly – often taking 2–6 months and tens of thousands of dollars in legal, tax, and administrative fees. From registering with authorities to opening bank accounts, the process diverts precious time and capital. Every month spent on red tape is a month of lost opportunity.

- Compliance & Labor Laws: Each country (and even each Canadian province or U.S. state) has unique labor laws, tax regulations, and employment requirements. For a startup without in-house legal teams, keeping up with varying rules is daunting. Missteps in classifying employees, observing public holidays, or filing paperwork can incur hefty fines or derail expansion plan. For example, misclassifying a full-time worker as a contractor – a common mistake – can trigger legal action and retroactive penalties.

- Payroll & HR Headaches: Managing payroll across borders is complex. Different currencies, withholdings, benefit mandates, and pay schedules can overwhelm a small HR team. A delay in paying overseas staff or a tax filing error can damage a startup’s reputation. Without local HR infrastructure, tasks like providing benefits, handling terminations, or resolving disputes become difficult.

- Resource Drain: Above all, these operational tasks steal focus from core business growth. Founders and teams end up buried in compliance work when they should be iterating the product or acquiring users. It’s hard to maintain a “move fast and break things” ethos when you’re worried about breaking the law in a new country.

What is an Employer of Record (EOR) and How Can It Help?

An Employer of Record (EOR) is a service provider that acts as the official, legal employer for your hires in a given region – handling all the payroll, taxes, and employment compliance on your behalf. In practical terms, the EOR becomes the “employer on paper” for your team members in that location, while your startup still directs their day-to-day work and retains full control over their projects and performance.

By partnering with an EOR, startups can hire talent anywhere without setting up a local entity or subsidiarydivinosolutions.com. The EOR takes care of registering the employee, issuing contracts compliant with local law, withholding and paying taxes, providing mandated benefits, and ensuring labor law compliance. It’s like instantly plugging into a ready-made HR, legal, and payroll infrastructure abroad – without the usual time and expense.

Here’s how an EOR works in a startup scaling scenario: imagine you’ve found a brilliant software developer in Germany and a sales rep in Brazil, but your company has no offices outside your home country. Normally, you’d need to incorporate locally or rely on risky contractor arrangements. With an EOR, you simply tell them, “I want to hire this person.” The EOR employs the individuals under its local business entity, handles all the onboarding paperwork and legalities, and then leases the employees back to your startup. Your new hires can often start in a week or less, instead of waiting 3–6 months to establish a foreign entity. This means immediate productivity with minimal upfront hassle.

Crucially, the EOR model is fully compliant. Since the worker is a formal employee of the EOR in-country, there’s no question of violating labor laws or misclassifying their status. All mandatory taxes, insurances, and benefits are handled for you. It’s a turnkey solution that “eliminates the need for separate legal and HR infrastructure in each new location”, freeing you to focus on core business activities and building your startup dream.

Key Benefits of Using an EOR to Scale Fast

Why are so many high-growth startups embracing the EOR approach? Simply put, an EOR removes the typical roadblocks to fast expansion. Here are the top ways an EOR enables rapid scaling:

- Lightning-Fast Market Entry: Skip the months-long entity setup and hire in days. With an EOR, you can onboard employees in new countries almost immediately, because the legal framework is already in place. This speed to market is vital when chasing first-mover advantage or meeting investor growth targets. Instead of waiting on incorporation paperwork, you have boots on the ground right away. As one guide put it, EORs let you “hire without borders,” bypassing bureaucracy and allowing you to “bring on talent in days, not weeks”.

- Global Talent Access: An EOR empowers startups to tap into a worldwide talent pool without worrying about local hiring formalities. Need a machine-learning engineer in Silicon Valley, a UX designer in Toronto, or a marketing specialist in London? No problem – the EOR can employ team members in any city or country where it operates. This means your hiring isn’t limited by your startup’s physical location. You can attract top-tier specialists anywhere in the world, giving you a competitive edge in innovation. In today’s remote-work era, the geographical barriers to hiring are dissolved – an EOR makes that possible by handling all local employment nuances.

- Compliance Without Headaches: Labor compliance is taken off your plate. EOR providers are experts in local employment laws – it’s their core business to keep up with regulatory changes, visa requirements, tax codes, and everything in between. They ensure every hire is fully compliant with local labor laws, tax regulations, and employment standards, shielding your startup from legal risks and “hefty fines” that can come with getting it wrong. For example, if you’re expanding into Europe or across Canadian provinces, an EOR will make sure each employee’s contract, working hours, overtime, and benefits follow the region’s rules. You won’t need internal lawyers in every jurisdiction because the EOR’s compliance team has you covered. This peace of mind lets you scale with confidence rather than fear of unknown legal traps.

- Cost Efficiency: Growing globally via an EOR is far more cost-effective than the traditional route. Setting up foreign subsidiaries isn’t only slow – it’s expensive, often involving five-figure costs per country in legal, accounting, and admin expenses. By contrast, EOR services charge a straightforward fee (usually a monthly or percentage-of-payroll model) to handle your overseas employment. You save on entity setup costs, ongoing overhead of local offices, and avoid hiring internal HR staff in each region. Moreover, you only pay for what you use – if you end up not needing that presence long-term, you can exit with minimal sunk cost. As one source notes, EORs allow startups to “experiment with new markets at no initial cost”, unlike establishing a physical entity that commits significant funds upfront. In essence, EOR turns expansion from a fixed capital expense into a variable operational expense aligned with your growth.

- Streamlined Payroll & Benefits: An EOR handles all the payroll processing, tax withholding, and benefits administration for your international team. This means no more struggling with foreign tax forms or benefits enrollment – the EOR ensures every employee is paid accurately and on time in their local currency, with correct deductions for income tax, pension, social contributions, etc. They also manage statutory benefits and insurance as required by local law (e.g. health insurance, retirement plans, paid leave). For a startup, this level of service removes one of the most complicated aspects of global hiring. As noted in one analysis, payroll across different currencies and tax regimes can be a nightmare even for big companies – EORs take care of it all. The result is happy employees (who get their salary and benefits without issue) and a happy finance team (who doesn’t have to become international payroll experts overnight).

- Flexibility to Scale Up or Down: Startups must be agile – you might surge hiring during a growth spurt or need to pivot and downsize a team in a non-viable market. EORs make this elasticity easy. Because you’re not tied into maintaining a branch office, you can scale your workforce up or down without dealing with entity shutdowns or complex legal exits. Want to test a market by hiring 5 people in Australia? The EOR can onboard them. If the market doesn’t pan out, you can terminate those roles through the EOR with minimal fuss (the EOR will ensure all local notice and severance rules are handled). This “hire fast, exit cleanly” capability de-risks market entry. Similarly, if you need to rapidly add 50 staff for a new contract and then scale down, the EOR can accommodate that surge. This flexibility means you only expand your team as needed, with zero friction from an HR/legal standpoint. In the words of one SaaS startup advisor, EOR enables “elastic growth – expand today and pivot tomorrow” as needed.

- Focus on Core Business: Perhaps the most underrated benefit – using an EOR lets your core team stay focused on what truly matters: developing products, winning customers, and scaling the business. Every hour you and your team don’t spend wrestling with foreign bureaucracy is an hour gained for strategy and innovation. EORs handle the red tape so you can concentrate on your startup’s mission. As one startup HR expert put it, time spent on “legalese, tax filings, or compliance checklists is time taken away from what matters most – the product, the users, and the growth strategy”. By offloading administrative overhead to an EOR, your internal resources remain committed to growth-driving activities. The EOR essentially acts as an extension of your HR/finance department, minus the distraction and overhead for you.

- Improved Employee Experience: When expanding quickly, it’s easy to overlook the employee’s perspective. But hiring through a reputable EOR can actually enhance the experience for your international team members. They receive fully legal employment status with all due benefits and protections, which increases their job security and satisfaction. Local nuances – from observing public holidays to issuing legitimate pay stubs for tax purposes – are handled correctly. This professionalism makes your startup look more credible and caring as an employer in new markets. Employees can access support (e.g. an HR contact at the EOR for any payroll questions) and often get self-service tools to view payslips or update details. In short, EORs help ensure your remote employees feel just as valued and taken care of as those in your headquarters. That means better retention and performance from your global team.

- Investor and Stakeholder Confidence: Savvy investors know the pitfalls of scaling too fast without infrastructure. Using an EOR demonstrates that your startup is pursuing growth responsibly. You can show a clear, compliant hiring plan for new markets, which can boost investor confidence in your global strategy. In fact, some venture capitalists prefer that startups use EORs in early global expansion because it reduces risk and speeds up deployment of capital into headcount. By partnering with an EOR, you signal that you’re serious about international growth but also mindful of legal and financial prudence – a combination any board will approve of.

How to Leverage an EOR in Your Scaling Strategy

Engaging an EOR is straightforward, but to maximize its value, consider these actionable steps as you integrate EOR services into your growth game plan:

- Identify Target Markets and Roles: Start by mapping out where you want to expand and which roles you need to hire. An EOR can typically support hiring in 150+ countries worldwide, but it’s wise to prioritize markets strategic to your business. For instance, a Canadian startup might use an EOR to quickly add sales reps in the U.S. and Europe, or a Silicon Valley startup might tap into tech talent in Canada through an EOR partner. Define the skillsets and timing required. This will help your EOR provider ensure compliance in those specific locations and prepare the proper contracts.

- Choose the Right EOR Partner: Not all EOR providers are equal. Look for one with a strong presence in your target regions and a track record with startups. Key factors include:

- Geographic Coverage: Do they operate in the countries or provinces you need? A provider with local entities in dozens of countries (and across Canada or U.S. states) will smooth out any jurisdictional wrinkles.Compliance Expertise: Ensure they have in-house legal and HR experts for each region. You want specialists who know, for example, French labor law or Ontario employment standards by heart.Technology & Efficiency: A modern EOR uses technology (platforms, dashboards) to automate and streamline onboarding, payroll, and reporting. This makes your life easier. (One EOR platform even uses AI to auto-generate compliant contracts and monitor changes across 170+ countries!Service and Support: As a startup, you need quick answers. Choose an EOR known for responsive support – ideally with a dedicated account manager. Check if they offer guidance during setup and have transparent SLAs for issue resolution.Pricing Model: Understand their fees – whether it’s a flat monthly rate per employee or a percentage of payroll. Reputable EORs are transparent about costs, helping you forecast expense as you scale. Avoid providers with a maze of hidden fees.

- Integrate the EOR Early: Engage your EOR partner early in your expansion planning. They can advise on local hiring norms or any red flags (e.g. maybe in Country X it’s better to hire via fixed-term contract, or certain benefits are mandatory at a higher level than you thought). Early integration ensures that by the time you’re ready to onboard your first hire in a new region, the EOR has everything prepared – from draft contracts to payroll accounts. This proactive approach can cut down ramp-up time and avoid last-minute hiccups.

- Onboard and Communicate: When you do hire via the EOR, make sure the new team members still feel fully part of your company culture. The EOR handles the HR paperwork, but you should onboard the employee into your workflows, introduce them to the team, and communicate responsibilities clearly. Also maintain communication with your EOR account managers – treat them as partners. Regular check-ins can catch any compliance updates or upcoming changes (for instance, a new labor law in the country) so you’re never caught off guard.

- Monitor Performance and Plan Transition (If Needed): Using an EOR doesn’t have to be permanent. It’s often a bridge solution while you scale. Track how the arrangement is supporting your goals. If down the line your startup grows to a point where establishing your own entity in a key market makes sense (usually once you have dozens of employees in one country and a long-term commitment there), plan the transition carefully. Top EOR providers will even assist in smoothly transferring employees from the EOR to your new entity when the time comes. That said, many startups stick with the EOR model for years as it continues to provide flexibility. Evaluate what’s best for your stage of growth.

Real-World Example

To illustrate the impact of an EOR, consider a hypothetical (but common) scenario:

AlphaTech is a U.S.-based startup ready to expand into Canada and Europe to support a surge in new customers. They need support staff in Canada, a sales rep in Germany, and a developer in India. Instead of spending the next 6 months and a small fortune setting up three foreign entities, AlphaTech partners with an EOR. Within a few weeks, the EOR hires five customer support agents across Ontario and Québec for AlphaTech, all fully compliant with Canadian labor laws (bilingual contracts in English/French, CRA payroll remittances handled). Simultaneously, the EOR’s European branch onboarded the German sales rep, and their Asia-Pacific arm took on the India developer – each according to local regulations.

AlphaTech’s team of 7 new international employees are up and running in record time, helping the company capture market share and serve customers in local time zones. AlphaTech’s founders didn’t have to learn foreign HR rules or open offices abroad – the EOR made what would normally be a bureaucratic nightmare into a smooth process. A senior leader at AlphaTech remarked that using an EOR was “the easiest way to legally expand our team across provinces and countries”, letting them hire remote staff quickly “without worrying about provincial payroll rules or tax setup”divinosolutions.com. The startup could focus on its product and clients while the EOR handled the rest.

Accelerate Your Growth with Divino Business Solutions (CTA)

If your startup is looking to scale rapidly and globally, Divino Business Solutions is here to help make it happen. We are Canada’s trusted partner for Employer of Record services, HR compliance, and payroll management. With Divino as your EOR, you can hire talent anywhere in Canada, the U.S., or abroad without setting up local entities or risking compliance issuesdivinosolutions.com. We handle the legal employer responsibilities – from onboarding paperwork and CRA tax remittances to benefits administration and labor law compliance – while you continue to guide your team’s daily work.

Divino’s EOR solutions are designed with growing startups in mind. We offer:

- Fast, Compliant Hiring: Onboard employees across provinces or countries in days. No need to navigate provincial taxes or U.S. state registrations on your own. We’ve got it covered.

- Expert Support: Our team of HR and legal experts stays on top of employment laws across Canada and internationally. No fines, no misclassification headaches – we keep you fully compliant, so you can expand with confidence.

- Tailored Service: Whether you need to hire one person or fifty, for a 3-month project or a full-time role, we provide flexible solutions. Payroll, contracts, benefits, terminations – all handled seamlessly to match your needs.

- Focus on Growth: By letting Divino shoulder the HR burden, your time is freed up to scale your product, acquire customers, and secure funding. As our client Jessica Patel noted, “Divino’s EOR support helped us hire remote staff quickly without worrying about payroll rules or tax setup.” You concentrate on performance and growth, we take care of the paperwork.

Ready to scale your startup fast? Contact Divino Business Solutions today for a free consultation on our EOR services. We’ll partner with you to remove the barriers to expansion. With Divino as your Employer of Record, you can turn your bold growth plans into reality – quickly, safely, and affordably.

FAQs

Q: What does an Employer of Record (EOR) actually do for a startup?

A: An EOR becomes the legal employer for your hires in a given region. It handles all employment-related functions – payroll, tax withholding, drafting local-compliant contracts, registering with authorities, providing benefits, and ensuring labor law compliance. Essentially, the EOR takes on the back-office HR and legal workload. Your startup still recruits and directs the employees’ day-to-day tasks, but the EOR manages everything that a “employer” normally would. This allows a startup to hire in new states or countries without needing its own legal entity or HR infrastructure there. It’s a way to plug into a turnkey employment platform to support your growth.

Q: When should a startup consider using an EOR?

A: Use an EOR when you want to expand into a new geographical area quickly and with minimal hassle. Common scenarios include: hiring your first employee or two in a foreign country (where setting up a subsidiary is overkill), testing out a new market or region, or building a remote team across multiple jurisdictions. If you don’t have a local entity and don’t want to spend months on setup, an EOR is the perfect solution. Early-stage startups often use EORs to go global right after funding rounds so they can seize market opportunities immediately. It’s also useful if you’re unsure about a market’s long-term viability – you can hire now via EOR, and if you later decide to establish a permanent office, you can transition (many wait until they have dozens of employees in one country). In short, whenever compliance complexity or speed is a concern in hiring abroad, an EOR should be on the table.

Q: Is it legal to use an Employer of Record in the U.S. and Canada?

A: Yes – using an EOR is a well-established, legal practice in both the U.S. and Canada (and many other countries). EOR providers operate within the bounds of labor laws. In the U.S., an EOR simply acts as the employer for IRS and Department of Labor purposes (similar to a staffing agency model), which is legal. In Canada, EORs (sometimes called “Employers of Record” or “administrative employers”) are also permissible – they must follow federal/provincial employment standards when hiring on your behalf. The key is to use a reputable EOR that properly adheres to all regulations. Top EOR firms ensure employment contracts, tax withholdings, and benefits are fully compliant with local laws. There are a few countries with restrictions on EOR arrangements, but for the vast majority of jurisdictions including North America, EORs are completely legal and widely used by businesses for global hiring.

Q: How fast can an EOR get someone on board compared to doing it myself?

A: In many cases, an EOR can have your new hire legally onboarded within a matter of days. All the heavy lifting – registering the employee, setting up payroll – is already prepared by the EOR. By contrast, if you do it yourself by establishing a foreign entity, it might take 2–6 months to get everything in place before you can even hire. For example, setting up a subsidiary in another country often means waiting on government approvals, setting up bank accounts, and hiring local accountants and lawyers; only then can you start hiring, which is far from “fast.” An EOR shortcuts this entirely. One resource notes that you can “skip the months-long process of entity setup and bring on talent in days” with an EOR. So instead of a new hire starting next quarter, they could be contributing to your startup next week. That speed can be crucial for grabbing opportunities or filling skill gaps quickly.

Q: Does using an EOR mean the employees aren’t really working for our startup?

A: The employees you hire via an EOR work for you in practice – they are 100% dedicated to your company’s projects, follow your direction, and function as members of your team. The difference is, on paper (for legal and payroll purposes), their “employer” is the EOR company. Think of it as a tri-party relationship: you (the startup) -> the EOR -> the employee. The EOR is the employer of record, but you are the worksite or operational employer. From the employee’s perspective, they may know that a third party handles their paychecks and benefits, but their day-to-day job is with your startup. You often give them your company’s email, include them in team meetings, even list them on your website – they are for all intents and purposes your staff, just employed through a service. This setup simply handles administrative aspects in the backend. Most employees hired through EORs are quite comfortable with the arrangement, especially since it often provides them full benefits and legal employment status in their country.

Q: What’s the difference between an EOR and a PEO or staffing agency?

A: Great question – there are a few related concepts. A PEO (Professional Employer Organization) is somewhat similar to an EOR, but typically requires the client company to have a legal entity and operates under a co-employment model (common in the U.S. for managing HR for domestic employees). In a PEO, you and the PEO share employer responsibilities, whereas with an EOR, the EOR is the sole legal employer. PEOs are usually used when you are not expanding internationally but need HR help in a country where you’re already established. On the other hand, a staffing agency is focused on recruiting and placing workers (often temporary or contract roles). Staffing agencies might act as the employer for temp workers, but they typically don’t handle long-term employment compliance the way an EOR does. They also actively source candidates, which EORs do not – with an EOR, you generally find and choose your candidate, and the EOR just employs them for you. In summary: EOR = you have a candidate and need to employ them compliantly abroad; PEO = you have an entity and want to offload HR admin; Staffing Agency = you need help finding temporary workers. Some providers (like Divino) offer hybrid services that can cover multiple needs, but these definitions cover the core differences.

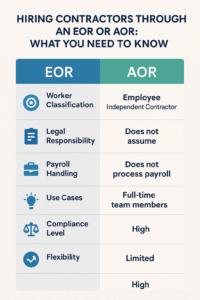

Q: Can I hire independent contractors through an EOR as well?

A: Typically, EOR services are geared toward hiring workers as employees (with all the normal withholdings and benefits). If you have a true independent contractor who invoices you and works on their own terms, you usually don’t need an EOR for that – you can engage them directly via a contractor agreement. However, many EOR providers also offer services for contractors or partner with Agent of Record (AOR) services. An Agent of Record (AOR) is a service that helps manage and pay independent contractors while ensuring compliance (but without employing them directly). It’s essentially the contractor equivalent of an EOR. In some cases, if you’re unsure whether a worker should be a contractor or employee, an EOR can advise. Some EORs will indeed put a contractor onto their payroll as a short-term employee if that’s safer for compliance. So yes, you can engage contractors through an EOR, but it usually means they’d be converted to a fixed-term employee under the EOR for the duration of their work. This can be a smart move if the contractor is working full-time for you and you want to avoid any risk of misclassification. (For more details on this, see our next article on whether contractors can be hired through an EOR.)

Q: How much does an EOR cost?

A: EOR pricing varies by provider and country, but common models are either a flat monthly fee per employee or a percentage markup on the employee’s salary (often around 5-15%). For example, if an employee’s gross salary is $5,000/month, the EOR might charge an additional fee (say $500) on top to cover their services. Some charge lower percentages but have a minimum fee. There may also be one-time setup fees per employee in some cases. While this is an added cost, remember that using an EOR saves you the expense of setting up a local company, hiring local HR staff, and possibly avoiding penalties – expenses that can far exceed the EOR fees. In many cases, the speed and compliance assurance are worth the cost. It’s wise to get a quote based on the specific country and role, and always ask the EOR to clarify what’s included (payroll processing, local tax filings, etc.) so you have a full picture. Compared to the overhead of doing it yourself, EORs are often quite cost-efficient, especially for small teams abroad. Check out how to simplify recruitment or The Bias of Interviews: Are You Just Hiring a Smile?

References

1. Social Hire – Scaling with Speed: How Startups Can Benefit from Using an EORsocial-hire.comsocial-hire.com

2. GroConsult – How EOR Services Can Help Startups Scale Quicklygroconsult.comgroconsult.com

3. Growth Navigate – Why SaaS Startups Love EOR: Speed, Scalability, Simplicitygrowthnavigate.comgrowthnavigate.com

4. Borderless AI – Employer of Record for Startups: Scale Teams Globallyhireborderless.comhireborderless.com

5. American SPCC – Why More Startups Are Choosing EOR for Global Expansionamericanspcc.orgamericanspcc.org

6. Rapid.one – Avoiding Contractor Misclassification via EORrapid.one

7. CPS (Corporate Payroll Services) – Penalties for Misclassifying Employees as Contractorscpsgo.com

8. BambooHR – Employer of Record Explained: A Practical Guidebamboohr.com

9. Divino Solutions – Employer of Record Services in Ontario (Divino Business Solutions)divinosolutions.com