Hiring independent contractors can be a smart way for companies to stay flexible and tap specialized skills. Contractors (freelancers, gig workers, consultants, etc.) offer firms the ability to scale work up or down without the commitments of full-time employment. But a common question arises: can contractors be hired through an Employer of Record (EOR), just like full-time employees are? This question often stems from concerns about compliance and avoiding costly misclassification mistakes. The short answer is yes, an EOR can facilitate the hiring of contractors in certain scenarios, though the approach may differ from standard employee hires. In this article, we’ll break down the relationship between contractors and EORs, clarify misconceptions, and give guidance on how to compliantly engage independent contractors – whether directly, through an EOR, or via related solutions – in both the United States and Canada.

Contractors vs Employees: Understanding the Difference

Before diving into EORs, it’s crucial to understand what separates an independent contractor from an employee in legal terms. This classification affects how you can or should hire someone:

- Independent Contractors (1099 contractors in the U.S.): These are self-employed individuals or entities who provide services to a business under a contract. They typically control when, where, and how they perform their work. Contractors usually work with multiple clients, use their own tools, and are not on the company’s payroll – they invoice for their services and handle their own taxes and insurance. They also generally do not receive benefits like health insurance or paid leave from the client company. In Canada, they’re often called contractors or consultants and similarly are not covered by employment standards for vacation, overtime, etc., if truly independent.

- Employees (W-2 employees in the U.S.): These individuals work under the direction and control of the employer. The company dictates their work schedule, processes, and tools. Employees have taxes withheld from their paychecks, and employers contribute to programs like Social Security/Medicare (U.S.) or CPP/EI (Canada). They are usually entitled to benefits and protections under labor laws – such as minimum wage, overtime pay, termination notice, and access to employment insurance. They receive regular wages via payroll and a W-2 form (in the U.S.) or T4 (in Canada) for tax purposes.

The distinction can sometimes be nuanced. For example, if a person works exclusively for one company, follows that company’s instructions closely, and is integrated into the business, they might legally be an employee even if you call them a “contractor.” Authorities like the IRS, U.S. Department of Labor, or the Canada Revenue Agency use multi-factor tests to determine a worker’s true status (considering degree of control, financial arrangement, relationship permanence, etc.).

Misclassification – calling someone a contractor when they function as an employee – is a serious issue. Studies have found that 10–20% of employers misclassify at least one worker as a contractor when they should be an employee. This can lead to legal and financial penalties. For instance, if discovered, a company may owe back taxes, unpaid benefits, overtime pay, and face fines. In the U.S., misclassification can result in IRS penalties and Department of Labor sanctions, not to mention liability for missing out on things like workers’ compensation coverage. In Canada, misclassification (sometimes called “dependent contractor” issues) can trigger fines of 10%–20% of unpaid taxes plus interest, and provincial labor ministries can levy additional penalties under employment standards laws. In short, treating someone who works like an employee as if they’re an independent contractor is risky.

Why the Question of “Contractors Through an EOR” Comes Up

Given the risks above, companies often seek ways to mitigate misclassification while still enjoying contractor flexibility. This is where the question arises: Can we use an Employer of Record to hire contractors? The idea is that maybe an EOR, being an expert in employment, could handle or “umbrella” the contractor to ensure compliance.

Traditionally, an Employer of Record’s primary role is employing people as employees (with proper payroll and benefits) on behalf of a client company. You typically wouldn’t use an EOR if someone is a true independent contractor because an EOR would convert them to an employee status. In fact, some experts note that the concept of hiring independent contractors through an EOR is a bit of a contradiction – if they remain independent, there is no employment to record. However, the landscape is evolving:

- Direct Contractor Engagement: If you have a short-term project or need a specialized freelancer, you can simply contract with them directly. You agree on a fee, they do the work, invoice you, and you pay them – no EOR needed. But you must ensure the contract is robust and that the person truly qualifies as an independent contractor under law (e.g. they have their own business, you’re not micromanaging their schedule, etc.). If you only have a handful of contractors and you’re confident about their status, direct engagement can work fine.

- When You’re Uncertain or Have Many Contractors: If your business model relies on numerous contractors or you have long-term contractors that look a lot like employees, the risk increases. For example, hiring a “contractor” full-time for a year, requiring them to work 9–5 on your systems – this is likely misclassification. In such cases, companies might think of using an EOR.

- EOR as a Compliance Safety Net: By routing a would-be contractor through an EOR, you essentially decide to treat them as an employee of the EOR (not a contractor). The individual would then be hired by the EOR as a regular employee (often on a fixed-term employment contract if the engagement is temporary) and then assigned to work for your company. This way, they receive all the legal benefits of employment – and you eliminate the misclassification issue because they’re not a contractor anymore. They’re a legitimate employee (of the EOR) working for you. This strategy is sometimes used if, say, a company expands to a country and initially planned to pay someone as a contractor but learns that local law would deem that person an employee due to the nature of work. By using an EOR, you “err on the side of caution” and employ them properly.

- Contractor Management Services (AOR): In recent years, many global EOR providers have also started offering what’s known as Agent of Record (AOR) or contractor management services. An AOR helps manage the administration for independent contractors – handling things like payments, ensuring the contract terms meet local laws, sometimes offering them to buy into benefits – without classifying them as employees. The AOR does not become the legal employer; the contractor remains independent, but the AOR acts as an agent to facilitate a compliant engagement. This can include verifying the contractor’s business status, handling tax document issuance (e.g. 1099s in the U.S.), and making sure the scope of work in the contract won’t inadvertently create an employment relationship. Some EOR companies provide both services: EOR for employees and AOR for contractors.

In essence, the question of using an EOR for contractors is really a question of: do you want/need to turn that contractor into an employee (via the EOR) or keep them as a contractor but with some third-party support? The answer depends on the nature of the work and your risk tolerance.

Hiring Contractors Through an EOR – How It Works

If you decide that an individual contractor should be hired through an EOR, here’s what typically happens:

- Classification Decision: First, you (often with legal advice or the EOR’s guidance) determine that the person’s role is that of an employee, not a freelancer. Maybe they’re full-time or key to your operations – signs that pointing toward employment. This could be due to strict labor laws in the country (for example, some countries in Europe have limited definitions of independent contractors).

- EOR Onboards as Employee: The EOR will hire the individual as its employee in the relevant country. The person will sign an employment contract with the EOR (possibly a fixed-term contract if the project is temporary). The contract will outline salary, benefits, and any other statutory requirements. From a legal standpoint, the EOR is now the employer responsible for that person.

- Worker Gets Benefits & Protections: Once onboarded, the individual is no longer a “contractor” in the legal sense – they’re an employee of the EOR. This means they start receiving whatever benefits are required (or that the EOR offers) in that locale – health insurance, pension contributions, paid holidays, etc., pro-rated to their contract. They also have assurance of labor law protections (working hours limits, safety regulations, etc.). From the perspective of fairness and morale, this can be a positive for the individual – they aren’t in a grey area; they have a formal job with benefits. As one EOR provider noted, by using an EOR in this way, the individual “receives all the employment benefits they’re entitled to… and you avoid the risks of misclassification.”.

- You Direct the Work: Just as with any EOR-hired employee, your company still directs the person’s day-to-day work and can define their tasks and deliverables in the agreement with the EOR. They will function just like any other team member, except their paycheck comes from the EOR company. You might still colloquially refer to them as a “contractor” on your team because maybe they’re on a short-term arrangement, but legally they are a temp/contract employee via the EOR.

- Payment and Billing: Instead of paying the contractor’s invoices, you will pay the EOR an invoice for that person’s employment cost. The invoice will typically include the person’s wages, the employer contributions (taxes, social security, etc.), benefits costs, and the EOR’s service fee. The EOR then pays the employee (formerly contractor) through its local payroll. This often simplifies things for your finance team – you pay one vendor (the EOR) rather than dealing with myriad tax forms for each contractor.

- Ending the Engagement: If the work is completed or you no longer need the person, the EOR (as employer) will handle the termination in compliance with local law. That means if any notice period or severance pay is legally required, the EOR ensures it’s done properly. This is another layer of protection; a misclassified contractor who is let go could sue for wrongful termination, but if they were an EOR employee, the process is handled in a standard employment framework.

Using an EOR in this manner is effectively hiring the person as an employee to avoid the pitfalls of an improper contractor relationship. It is particularly useful when expanding to countries with strict contractor rules or when the contractor is performing core roles. For example, if a U.S. startup wants to “contract” a single full-time software developer in France, French labor authorities might deem that an employment – going through an EOR to officially employ that developer in France would be the compliant path.

Pros and Cons of Using an EOR for Contractors

Pros:

- Avoids Misclassification Risk: The biggest advantage is eliminating the gray area. By making the individual an employee (via EOR), you greatly reduce the legal risk of fines and penalties related to misclassification. You’re essentially following the law to the letter.

- Provides Benefits to Worker: The contractor-turned-employee gets benefits and stability, which can increase their loyalty and productivity. They don’t have to worry about handling their own taxes or missing out on healthcare, etc. In competitive fields, offering a contractor a full employment package (even via EOR) can make your offer more attractive.

- Compliance Managed by Experts: The EOR will ensure all local nuances (like mandatory vacation days or 13th-month bonus pay, if applicable) are handled. You don’t have to become an expert in that country’s contractor laws because you’ve chosen the employment route.

- Streamlined Administration: Especially if you have multiple contractors in different places, consolidating them through an EOR (or its contractor management system) can simplify payments and paperwork. One point of contact, one set of invoices.

Cons:

- Higher Cost: Hiring through an EOR means you’ll be paying employer costs that you might avoid if someone remained a true contractor. For example, as a contractor, you wouldn’t pay employer social security contributions, etc., but as an employee, those come into play. The EOR also charges a fee. So the total cost per worker is higher than paying a contractor’s invoice in many cases. You’re trading off cost for compliance safety.

- Contractor Preference: Some independent contractors prefer to remain independent for tax or lifestyle reasons. By asking them to be employed via EOR, you’re changing that dynamic. In the U.S., for instance, some contractors enjoy deducting business expenses or prefer the flexibility of no formal employer. They might not want to become an “employee” of an EOR. However, many are open to it if it’s the only way to get the gig (and especially if it’s short-term with a clear end date).

- Not Necessary for Short Gigs: If the contractor relationship is clearly limited (say a 2-week design project, or a one-off consulting report), going through the complexity of an EOR employment might be overkill. You might be better off just doing a straightforward contract and ensuring it’s within bounds.

- EORs Focus on Employees: Remember that not all EOR companies handle contractor arrangements. Some will tell you outright, “If they are truly a contractor, you don’t need us; just pay them directly.” Others have the AOR programs as mentioned. There could be scenarios where an EOR can’t onboard someone because the person insists on remaining independent (for example, maybe they have their own corporation and want to bill you through that). In those cases, the EOR might just facilitate a vendor agreement instead of an employment – which is essentially acting as a middleman.

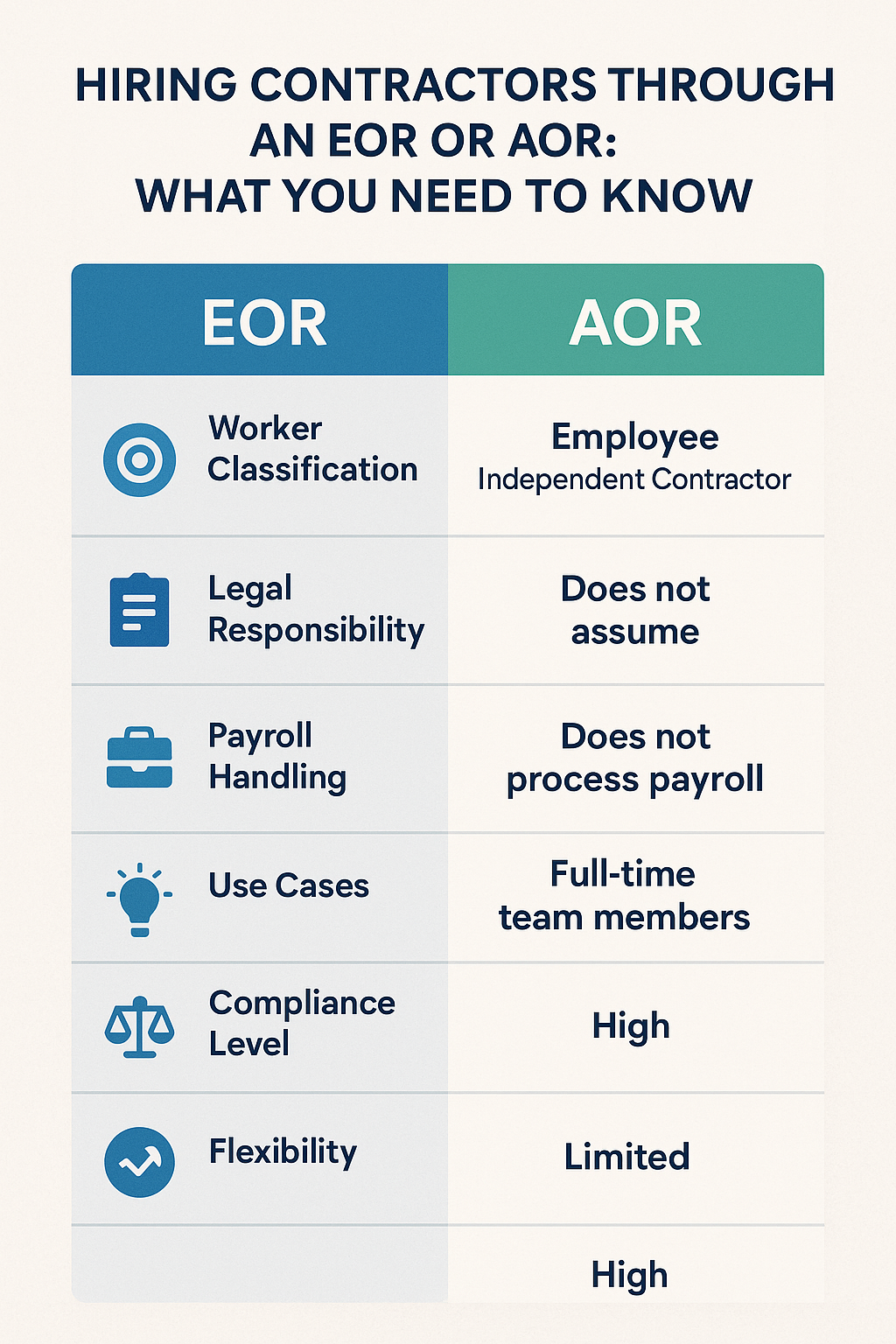

Agent of Record (AOR) vs Employer of Record (EOR)

It’s worth explicitly differentiating these terms as they relate to this topic:

- Employer of Record (EOR): The company that becomes the legal employer of your worker (used for employees). Ideal for when you want the person treated as an employee with all compliance boxes checked.

- Agent of Record (AOR): A company that helps manage independent contractor engagements. They do not employ the worker, but they may handle onboarding paperwork, verify the contractor’s business status, ensure the contract scope doesn’t imply employment, process payments, and withhold any required taxes (for example, sometimes a portion might need to be withheld if the contractor is in another country under tax law). The AOR basically acts as your agent in administering the contractor, hence reducing your risk while keeping the person a contractor. Some payroll platforms or freelancer management systems use this model.

If your question is specifically “Can I hire independent contractors through an EOR?”, the answer might actually be, “Consider an AOR service for that.” Many top global hiring firms offer both: they’ll say “EOR for full-time hires, AOR for freelancers.” For example, Papaya Global, Deel, Remote, and others have contractor payment services separate from their EOR offerings. These services typically charge a smaller fee just to process contractor invoices and ensure compliance documents (like W-8BEN forms, etc.) are in order.

In context, Divino Business Solutions (our example company) primarily acts as an EOR/employer for staffing placements and payroll. If you came to Divino with a need to engage a contractor, Divino could either employ that person on your behalf (if that made sense) or advise on how to properly contract with them if not.

Best Practices for Engaging Contractors (Directly or via EOR)

To wrap up, here are some actionable tips whether you keep contractors independent or decide to involve an EOR/AOR:

- Evaluate the Role: Ask yourself if the contractor’s role is core and ongoing (pointing to an employee relationship) or truly peripheral/temporary. If it’s core, lean towards an EOR solution. If it’s a one-off task, a simple contractor agreement might do – just draft it carefully.

- Check Local Laws: If the contractor is in another country, research or consult on how that country views contractors. Some countries have strict criteria. For instance, in some European countries, working for one client exclusively can automatically trigger employee status. If it looks strict, using an EOR to hire them as an employee from the get-go can save a lot of trouble.

- Use Clear Contracts: If engaging directly, make sure your independent contractor agreement clearly defines the scope, states that the person is an independent contractor responsible for their own taxes, and that no employment relationship is intended. It should avoid treating the person like a regular employee (e.g., don’t include things like paid vacation or requiring them to work at your office 9–5).

- Monitor the Relationship: Situations evolve. A contractor who started truly independent might, over time, start working only for you and taking on more duties like an employee. Conduct periodic reviews. If the relationship has changed, consider shifting them onto an EOR or hiring them outright. It’s better to proactively address it than wait for an audit or a dispute.

- Leverage EOR/AOR for Cross-Border: If you’re paying contractors overseas, remember there could be tax implications (for example, in some cases, you might have to withhold a portion of payment for tax treaties, etc.). Using an international EOR/AOR platform can ensure you handle those correctly. They can also help provide localized contract templates. For instance, they might ensure a Canadian independent contractor signs a contract that aligns with CRA guidelines, or a UK contractor’s agreement meets HMRC tests.

- Budget for Compliance: If you do decide to hire through an EOR, budget accordingly as mentioned. Factor in the employer costs. Sometimes companies initially balk at the added cost, but it’s often far cheaper than a misclassification lawsuit or the overhead of entity setup. It’s the cost of playing it safe.

In summary, yes, contractors can be engaged through an Employer of Record – but by doing so, you’re essentially choosing to make them an employee (of the EOR) for compliance purposes. Many businesses take this route to protect themselves and their workers. Others use specialized contractor management (AOR) services to similar effect without changing the worker’s classification. The right approach depends on the specifics of each case.

The golden rule is: don’t leave it to chance. If a contractor is integral to your business or working in a way that blurs the lines, take action – whether that’s hiring them via an EOR, converting them to a direct employee, or diligently structuring the contractor relationship with legal help. The costs of getting it wrong are simply too high in both the U.S. and Canada, where enforcement is increasing and courts often side with workers on these matters.

How Divino Business Solutions Can Assist (CTA)

At Divino Business Solutions, we specialize in helping companies navigate these tricky waters. As an HR, staffing, and payroll expert in Canada, Divino offers flexible solutions for both employing workers on your behalf (EOR) and engaging contingent staff safely. Whether you’re a growing business in Toronto needing to compliantly pay a U.S. freelancer, or a U.S. company looking to hire in Canada without a subsidiary, Divino can guide you.

- Employer of Record Services: If you decide a contractor should be an employee, we can onboard them under our Canadian EOR program, handling all payroll, tax, and benefit obligations. This is ideal for long-term hires or key personnel in Canada – you get the talent, we handle the legal employment. Your worker enjoys full compliance and protections, and you eliminate classification worries.

- Compliance Consulting: Not sure if your worker should be a contractor or employee? Our HR compliance experts can assess the situation. We’ll give you an honest evaluation and recommend the best path. Our goal is to keep you risk-free and in line with Canadian and provincial laws (and we keep an eye on U.S. and international best practices too).

- Payroll & Contractor Management: Even for true contractors, we can assist by managing their payments through our payroll systems, ensuring the paperwork (like invoices, tax forms) is handled correctly. This is especially useful if you have multiple contractors – we consolidate and streamline the process.

Don’t let misclassification nightmares haunt your business. Divino Business Solutions has the experience to handle both your permanent hiring needs and contractor engagements with utmost compliance. We pride ourselves on being a warm, trustworthy partner who takes the administrative load off your shoulders. You focus on your project deliverables – we’ll focus on making sure everyone gets paid correctly and by the book.

Thinking about hiring through an EOR or have questions about your contractors? Reach out to Divino for a free consultation. We’ll help you find the optimal solution, be it EOR, AOR, or something in between, tailored to the laws of Canada, the U.S., or wherever you operate. With Divino’s support, you can engage talent confidently and turn your workforce into a compliant, efficient engine for growth.

FAQs

Q: Do I need to use an EOR to hire independent contractors?

A: Not necessarily. If you are engaging genuine independent contractors (who meet all legal criteria as self-employed), you typically do not need an EOR. You can hire them directly via a contractor agreement. Many companies work with freelancers without any intermediary. However, you might choose to involve an EOR or similar service if you’re concerned about compliance or if the line between contractor and employee is blurry. For example, if you have a long-term contractor in another country and you’re not familiar with local laws, using an EOR could ensure everything is done correctly (often by converting that contractor to an employee). In short: direct hire is fine for true contractors, but use an EOR/AOR if you want an extra layer of compliance or if the contractor’s status is questionable.

Q: What are some signs that my “contractor” should actually be an employee?

A: Here are red flags that a worker classified as a contractor might be misclassified:

- They work full-time hours for you and have no other clients.

- You dictate their work schedule, location, or processes very tightly (they operate just like your employees).

- They use your equipment and tools and have an email address at your company.

- The work they do is core to your business (e.g., coding your product, managing your teams).

- They’ve been working for you for an extended period (a year or more continuously).

- The contract keeps getting renewed without much change in scope.

- They appear on your org chart or have a title like other employees.

If several of these apply, many labor authorities would likely consider them an employee. In such cases, shifting them to an EOR employment model can protect you and give them proper benefits. When in doubt, consult HR/legal experts – it’s better to adjust proactively than face a legal complaint later.

Q: Can an EOR handle short-term contractors or part-time gigs?

A: Yes, EORs can employ people for short durations or part-time roles as well. You can use an EOR to hire someone for even a few months if needed – the EOR would simply issue a fixed-term employment contract. For part-time, they would ensure things like pro-rated benefits or minimum wage thresholds are respected. There might be a minimum term or setup fee that makes it not cost-effective for extremely short gigs (e.g., a one-week engagement might be too short to bother with EOR in some cases). But generally, EORs are flexible – they can accommodate various working schedules. If it’s a very short or one-off project, you might lean toward keeping it a pure contractor relationship instead. EORs are most useful when the person is going to be working regularly (even if part-time) and you want them on payroll for compliance.

Q: What is the Agent of Record (AOR) and how is it different from EOR?

A: An Agent of Record (AOR) is a service focused on handling independent contractor engagements. The AOR does not employ the worker, unlike an EOR. Instead, the AOR acts as an intermediary to manage the administrative and compliance tasks associated with the contractor. For example, an AOR might:

- Verify the contractor’s business registration or right to work.

- Ensure the contract with the contractor has proper clauses and doesn’t create an employment relationship inadvertently.

- Handle payment processing to the contractor, including currency conversion or tax form issuance.

Think of AOR as a contractor management solution. It helps companies work with 1099 contractors or freelancers by taking care of paperwork and ensuring laws are followed (like not exceeding certain hours, etc.), but the contractor remains independent. In contrast, an EOR actually becomes the employer of the worker. Companies that provide global hiring solutions often offer both: you use EOR for hiring employees in a new country and AOR for paying contractors in a compliant way. So if you want to keep someone as a contractor but want help administratively, you’d use an AOR service. If you want to fully employ them, you’d use an EOR.

Q: What are the consequences of misclassifying a contractor?

A: Misclassification can lead to a world of hurt. If authorities determine you should have treated a worker as an employee, your company could be on the hook for:

- Back wages (e.g., paying them for overtime or holidays that employees would have gotten).

- Back taxes (both employer and employee portions of payroll taxes that weren’t paid, with interest). For example, the IRS can impose fines and require payment of Social Security/Medicare contributions that were avoided.

- Benefits restitution: covering the cost of benefits the worker missed (health insurance, retirement contributions).

- Penalties and fines: These vary by jurisdiction. In the U.S., there are federal and state penalties; for instance, a willful misclassification can lead to additional fines per incident. In Canada, provinces like Ontario, under laws strengthened in recent years, can levy fines (and even publish violators) for misclassification offenses.

- Legal fees and settlements: Often the issue comes up when a worker files a complaint or lawsuit (maybe they were let go and file for unemployment, triggering an audit). Companies may end up settling with the worker by paying an agreed sum.

- Damage to reputation: Repeated or egregious cases can harm your standing with regulators and make future audits more likely.

In short, the costs can far outweigh what you might have “saved” by treating someone as a contractor. That’s why companies increasingly err on the side of caution – either by using EORs or tightening their contractor policies. As one legal fact sheet noted, courts and agencies often side with workers on these issues, and a significant percentage of employers have been found non-compliant. So it’s a risk not worth taking. If in doubt, fix the classification now (for instance, hire the person via an EOR or directly) rather than hoping it slides under the radar.

Q: How does hiring contractors through an EOR work in Canada specifically?

A: In Canada, the principles are similar to the U.S., though terminology differs (no “1099 form” in Canada, but the idea of independent contractor vs employee is analogous). If you hire a Canadian worker through an EOR, that EOR (like Divino, for example) would become their legal employer in Canada. This is often used by foreign companies with Canadian contractors – instead of risking that CRA or provincial authorities say “hey, this person looks like an employee,” the foreign company uses a Canadian EOR to employ them properly. The EOR deducts income tax, contributes to CPP (pension) and EI (employment insurance), etc., which a contractor arrangement might skip. Misclassification in Canada can lead to having to pay those CPP/EI premiums retroactively with penalties. By using an EOR, you ensure the worker is on payroll with proper deductions from the start. For domestic Canadian companies, if you have a “contractor” who works only for you and under your direction, you should likely put them on payroll (whether via EOR or internally) to comply with provincial employment standards and federal tax law. The use of an EOR in Canada for contractors is a protective measure – it’s recognized and allowed. Just be sure the EOR is knowledgeable about Canadian labor codes. Divino, for instance, highlights that without expert EOR support, companies face fines and “misclassified employees” risks Divinosolutions.com – indicating our services are aimed at preventing exactly that scenario. Check out how to simplify recruitment or The Bias of Interviews: Are You Just Hiring a Smile?

References

1. AllWork – EOR vs AOR: What’s the Difference?allworknow.comallworknow.com

2. CPS (Corporate Payroll Services) – Penalties for Misclassifying Contractorscpsgo.comcpsgo.com

3. Rapid.one – Contractor Misclassification Risks (India example)rapid.onerapid.one

4. Social Hire – Scaling with Speed via EOR (misclassification context)bamboohr.com

5. Divino Solutions – EOR Services Page (Compliance emphasis)divinosolutions.comdivinosolutions.com

6. American SPCC – Startups Choosing EOR for Expansionamericanspcc.org

7. Wisemonk – What is an EOR? (FAQ on contractors)wisemonk.io