Hiring across Canada should feel exciting—not like you’re wrestling a mountain of forms, registrations, and rules. That’s where an Employer of Record (EOR) comes in. If you’ve ever wished you could hire anywhere in Canada without building a full HR function in every province, an EOR is your shortcut: the EOR becomes the legal employer in Canada, you manage the work, and the EOR handles payroll, taxes, benefits, and compliance. Easy.

In this guide, we’ll break down what an Employer of Record in Canada actually does, how the model works from coast to coast, and where it makes the most sense (foreign market entry, multi-province teams, short-term projects, rapid scaling, and tariff-driven pivots). We’ll also cover EOR vs PEO vs traditional hiring, and explain how Divino differentiates with fast onboarding, strong pricing, and truly local support across all provinces.

TL;DR (for busy founders and HR leaders)

- EOR = legal employer on record in Canada. You direct the day-to-day work; the EOR runs payroll, remits CPP/EI/income tax to the CRA, administers benefits, issues contracts, and keeps everything compliant with federal and provincial rules.

- Why it matters: Hire in days (not months), skip entity setup, and avoid penalties for payroll or employment-standards mistakes.

- Best for: Foreign companies entering Canada; Canadian startups scaling across provinces; short-term or remote hires; and teams adjusting to tariff/trade shifts.

- Divino’s edge: Speedy onboarding, fair and transparent pricing, and local, Canadian compliance expertise in every province and territory.

What Is an Employer of Record (EOR) in Canada?

Think of an EOR as your proxy employer. Legally, they employ your team member in Canada. Practically, you still choose talent, set goals, manage projects, and own the relationship. The EOR sits in the background, ensuring the employment piece is airtight: contracts, payroll, CRA remittances (CPP, EI, income tax), benefits, leave, and record-keeping. That’s the headache layer—off your plate.

The result: you can hire in Canada without opening a Canadian entity. Instead of navigating each province’s labor rules yourself, the EOR standardizes the process and keeps you compliant as you expand. This is especially powerful for distributed teams where people are in Ontario, BC, Quebec, Alberta, and beyond.

How the EOR Model Works (Step by Step)

- Scope & setup

You share the role, location(s), and timeline. The EOR confirms what’s required (province-specific contracts, notice/termination norms, minimums for vacation/holidays, and payroll cadence). - Employee offer & compliant contract

Once you’ve picked your candidate, the EOR issues a Canada-compliant employment agreement aligned to the right province. That includes essentials like pay, schedule, overtime rules, statutory holidays, vacation, leave entitlements, confidentiality/IP clauses, and termination terms. - Payroll & statutory programs

The EOR sets up payroll, calculates gross-to-net, withholds CPP, EI, and federal/provincial income tax, and remits to the CRA on schedule. Paystubs, T4s, and Records of Employment (ROE) are handled when needed. - Benefits & time-off

The EOR administers statutory entitlements (vacation, holidays, protected leaves) and any additional benefits you want to offer (health/dental/RRSP). They ensure minimum standards are met province by province. - Day-to-day management stays with you

You direct work, performance, and culture. The EOR remains invisible to your daily operations—unless you need help with policy, leave, or offboarding. - Compliance monitoring

The EOR tracks law changes (e.g., minimum wage updates, new leave rules, payroll thresholds) and updates documents/processes so you stay clean.

Bottom line: you get a turnkey, compliant employment layer in Canada—without spinning up entities, chasing registrations, or babysitting payroll calendars.

Why Hiring in Canada Is Tricky Without an EOR

Even Canadian businesses feel the friction; for foreign employers, it’s amplified. Here’s what typically slows teams down:

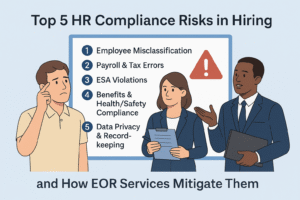

- CRA payroll & remittances: You must calculate withholdings accurately (CPP, EI, federal/provincial income tax) and remit on time. Missing or miscalculating can trigger penalties.

- Patchwork provincial rules: Most employment standards (wages, OT, holidays, vacation, leaves, termination/severance) are provincial. Hire in three provinces, and you’re juggling three playbooks.

- Entity & registrations: Foreign companies usually need to form an entity/branch, get a business number, set up payroll accounts, and register for workers’ comp in the province. That can take months.

- Admin overhead & risk: Contracts, ROEs, T4s, benefit enrolments, policy updates—it’s a lot. Misclassification or non-compliance can be costly.

An Employer of Record Canada solution collapses this complexity into one service and dramatically shortens time-to-hire.

The Benefits of Using an EOR (Canada-Specific Wins)

1) Hire in days, not months

Because the EOR already has the infrastructure and local entity, they can legally employ in any province quickly. You can land talent fast—perfect for high-priority roles or pilot teams.

2) Full-stack compliance

From contracts to payroll remittances and provincial standards, the EOR is built to keep you compliant across Canada. No late filings, no guesswork on leave entitlements, no scrambling for law updates.

3) Less admin, fewer vendors

One partner to handle employment agreements, payroll, CRA, benefits, records, and offboarding. No need to string together accountants, lawyers, and payroll software in every province.

4) Lower fixed costs & predictable pricing

Instead of entity setup and in-house HR/per-province advisors, you pay a clear per-employee fee plus the employee’s comp. It’s easier to forecast and often cheaper than DIY.

5) Pan-Canadian reach

Hire in Ontario, Quebec, BC, Alberta, Manitoba, Saskatchewan, Atlantic Canada, and the territories—without setting up shop everywhere. The EOR deals with each location’s quirks.

6) Better candidate experience

Fast, clean onboarding and reliable payroll/benefits builds trust from Day 1. You look like a well-oiled employer, even if your core team is lean.

When an EOR Shines (Use Cases That Just Work)

- Foreign company, first Canadian hires

Want one engineer in Montreal and a CS rep in Toronto? Skip entity setup and go live via EOR while you test the market. - Canadian startup scaling across provinces

Open roles wherever the talent lives. The EOR ensures each contract and payroll aligns with the right province. - Short-term or project-based roles

Six-month launch project in BC? Hire compliantly for the window you need, then offboard cleanly. - Tariff or trade pivots

If tariffs make local assembly or distribution more attractive, quickly spin up a Canadian team via EOR to adapt. - De-risking contractor conversions

If a “contractor” looks and behaves like an employee, move them to a clean employment setup through the EOR to avoid misclassification risk.

EOR vs PEO vs Traditional Hiring (and Staffing)

Here’s the plain-English comparison you can show your CFO:

- Traditional hiring:

You form a Canadian entity, register everywhere, build payroll/benefits, and own all compliance. Maximum control, maximum overhead. - PEO (co-employment):

Helpful for HR support when you already have a local entity. You remain the legal employer and keep shared liability. Good domestically; not a solution for foreign entry. - EOR (sole legal employer):

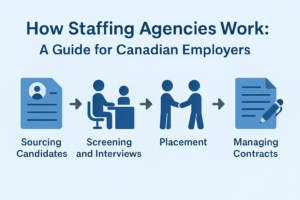

No local entity required. The EOR is the legal employer and assumes employment liability. You manage the work; they handle the legal employment layer. - Staffing/Recruitment agency:

Great for sourcing talent (and temp staffing). Not a replacement for long-term employment infrastructure. Many teams use both: recruiter to find, EOR to employ.

What an EOR Actually Handles in Canada (The Checklist)

- Employment agreements aligned to each province

- Payroll processing, CPP/EI/income tax withholdings and CRA remittances

- Paystubs, T4s, ROEs

- Benefits administration (statutory + optional)

- Vacation/holiday administration, provincial leave entitlements

- Employment records and document retention

- Policy updates as law changes (e.g., new wage floors, leave expansions)

- Offboarding (notice, pay in lieu, statutory docs)

- Optional help with workers’ comp registration and claims coordination

If it looks like HR/legal back-office, the EOR probably has it covered.

Divino’s EOR: Why Teams Choose Us in Canada

We designed Divino’s Employer of Record Canada offering to be the most practical, human, and fast way to hire anywhere in the country:

- Fast onboarding

Our workflows are tuned for speed. Typical cases go from “signed offer” to “on payroll” in days, not weeks. - Strong, transparent pricing

Clear per-employee pricing—no surprise legal bills or hidden admin fees. You’ll know your landed cost upfront. - Local, Canadian support

Real humans in Canada who live this compliance landscape every day. We help your team navigate Ontario ESA norms, Quebec specifics, BC wage changes, and everything in between. - End-to-end HR partnership

From compliant contracts to benefits and ROEs, we act like a plug-in HR department for your Canadian headcount—without adding headcount on your side.

If you want the speed of a startup with the compliance of an enterprise, that’s the balance we aim for.

Practical Examples (So You Can Picture It)

- US SaaS testing Canada:

You want to pilot customer success coverage in PST. We hire one rep in Vancouver (BC) and one in Calgary (AB) through Divino EOR. BC’s minimum wage and overtime rules are observed; Alberta’s holiday/vacation rules applied. Two weeks later, both reps are fully onboarded, paid in CAD, and you’re live on Canadian hours. - Toronto fintech scaling remote:

You’re winning deals across provinces and following the talent. You make offers in Ottawa (ON), Montreal (QC), and Halifax (NS). We issue province-specific contracts, turn on payroll and benefits, and keep every file CRA-clean. Your ops team doesn’t touch a single registration portal. - EU manufacturer adapting to tariffs:

Local service/assembly suddenly makes sense. You stand up a 4-person Canadian team—service tech, logistics coordinator, account manager, and QA—via EOR. If tariffs shift again later, you haven’t sunk months of time or big dollars into an entity you no longer need.

Risks You Avoid With an EOR

- Late/missed CRA remittances (penalties + interest)

- Misclassification (treating de-facto employees as independent contractors)

- Province-specific mistakes (overtime, holidays, vacation accruals, termination pay)

- Patchy documentation (missing ROEs/T4s, weak contracts)

- Benefits non-compliance or poor enrolment management

An EOR doesn’t just “run payroll.” It absorbs the employment risk and centralizes all the moving parts that create that risk.

How to Choose an Employer of Record in Canada (Quick Buyer’s Guide)

- Entity & coverage: Can they legally employ in every province and territory?

- Payroll depth: Are CPP/EI/tax remittances and T4/ROE issuance truly in-house and reliable?

- Contract quality: Do they issue strong, province-specific employment agreements (IP, confidentiality, termination clarity)?

- Benefits options: Can they provide competitive plans and handle enrolment and ongoing admin?

- Speed & SLAs: What’s the time-to-onboard and responsiveness?

- Pricing clarity: Flat per-employee or % of payroll? Any setup, exit, or hidden fees?

- References & local expertise: Do they have Canadian HR/legal experts you can actually reach?

Divino ticks these boxes—and we’ll happily walk you through the details.

Getting Started (Zero-Stress Plan)

- Tell us where and who you want to hire in Canada.

- We confirm the right province-specific contract and benefits.

- Offer goes out from the EOR (with your branding touches, if you like).

- We onboard: payroll, CRA, benefits, records, the works.

- You manage the work; we keep everything compliant behind the scenes.

If you later decide to open your own Canadian entity, we’ll help you transition employees cleanly from EOR to your payroll with no disruption.

Conclusion: Grow in Canada—Without the Red Tape

The Employer of Record Canada model gives you the best of both worlds: your team, your culture, your control—without the admin drag. Whether you’re expanding from abroad or scaling across provinces, an EOR lets you hire faster, stay compliant, and keep costs predictable. With Divino, you also get a partner that’s local, responsive, and built for speed.

Ready to unlock Canadian talent—every province, any time? Let’s make your next hire the easiest one yet.

FAQs

1) What does an Employer of Record do in Canada?

An EOR is the legal employer for your team members in Canada. They run payroll, withhold and remit CPP/EI/income tax to the CRA, administer benefits, issue compliant contracts, track leave, and handle records and offboarding—while you direct the work day to day.

2) Do I still manage my team if I use an EOR?

Yes. You hire (or approve) the person, set goals, assign tasks, and run performance. The EOR handles the legal employment behind the scenes.

3) How fast can I hire through an EOR in Canada?

For standard cases, onboarding can be completed in days (not months). Timeline depends on role complexity, benefits, and province.

4) What’s the difference between EOR and PEO in Canada?

A PEO typically requires your local entity and uses co-employment—you remain the legal employer. An EOR is the sole legal employer and no local entity is required. If you’re foreign and don’t have a Canadian company, EOR is the path.

5) Is an EOR cost-effective vs opening a Canadian entity?

In most early-stage or pilot scenarios, yes. You avoid entity setup, multiple registrations, and in-house HR tooling/staff. Pricing is usually a clear per-employee fee plus comp/benefits.

6) Can an EOR handle short-term or project roles?

Yes. EORs commonly manage fixed-term or project-based employment and clean offboarding with compliant notice or pay-in-lieu when the project ends.

7) Which provinces can I hire in with an EOR?

All provinces and territories. The EOR issues province-aligned contracts and ensures local employment-standards compliance (wage, OT, holidays, vacation, leaves, termination rules, etc.).

8) Who is responsible for CRA filings and payroll mistakes?

The EOR is responsible for accurate payroll, withholdings, and CRA remittances under the service agreement. You should still review payroll reports, but the EOR owns the process.

9) Can I convert contractors to employees via an EOR?

Yes—and it’s often safer. If the role functions like employment, moving to an EOR employee model helps avoid misclassification risk.

10) Can I move employees from EOR to my own Canadian entity later?

Absolutely. A good EOR will transition staff to your new entity smoothly—with new contracts and uninterrupted payroll/benefits.

Check out how to simplify recruitment or The Bias of Interviews: Are You Just Hiring a Smile?

Sources

- CRA, Employers’ Guide – Payroll Deductions and Remittances (T4001). Government of Canada

- CRA, Payroll Deductions Formulas (T4127)—CPP, EI, income tax calculations. Government of Canada

- ADP Canada, What is an Employer of Record? (overview of EOR handling payroll, taxes, benefits, compliance). ADP Canada

- Remote, How to use an Employer of Record in Canada (hire without establishing an entity). Remote

- Rippling, EOR in Canada: A Complete Guide (definition and scope). Rippling

- BC Government, Employment Standards (example of provincial standards; wage/OT/leave vary by province). Government of British Columbia

- ADP Canada, Employment Standards in Provinces & Territories (overview of provincial differences). ADP Canada

- Pivotal Solutions, PEO or EOR? (co-employment vs EOR sole employer). Pivotal Integrated HR Solutions

- Oyster HR, EOR in Canada: Concise Guide (EOR as legal employer; contracts, payroll, benefits, compliance). Oyster HR

- Papaya Global, Employer of Record in Canada (recent overview of responsibilities/benefits). Papaya Global