Introduction

Expanding your business internationally presents incredible growth opportunities—but hiring employees across borders also introduces significant legal and administrative complexities. Managing payroll, taxes, and labor regulations abroad can quickly overwhelm even seasoned HR teams. That’s exactly why more companies are turning to an Employer of Record (EOR).

This definitive guide will explain clearly what an EOR is, how it works, why businesses rely on them, and important factors to consider before partnering with an EOR. By the end, you’ll have the insights needed to determine if an EOR solution aligns with your international hiring strategy.

What Is an Employer of Record (EOR)?

An Employer of Record is a specialized third-party provider that assumes formal legal employment responsibility for your international employees. Although the EOR becomes the official employer on paper—handling payroll, tax compliance, benefits, and labor laws—your company retains complete day-to-day control over the employee’s tasks and responsibilities.

According to industry leader ADP, an EOR is defined as “a third-party provider legally responsible for another organization’s employees,” significantly simplifying international hiring processes.

Example Scenario

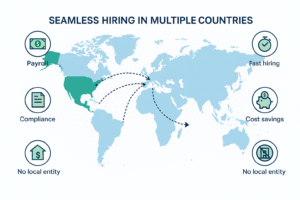

Imagine a Canadian tech firm wants to hire a software developer based in Brazil. Direct hiring would necessitate opening a legal entity in Brazil, registering for local taxes, and complying with intricate labor laws. By utilizing an EOR, the firm sidesteps these complexities, quickly onboarding talent compliantly without needing to establish a Brazilian entity.

Core Responsibilities of an EOR

- Payroll and Taxes: The EOR manages payroll processing, tax withholding, and statutory contributions, ensuring compliance with local regulations.

- Benefits Administration: Enrollment in required social programs, healthcare, retirement schemes, and local benefit standards.

- Employment Contracts: Ensures contracts meet all local labor standards.

- Onboarding/Offboarding: Handles legal paperwork, background checks, and termination procedures in alignment with local laws.

- HR Compliance: Addresses labor law adherence, audits, and employee inquiries, significantly reducing your legal exposure.

How Does an EOR Work?

The process of partnering with an EOR is designed to be straightforward:

- Select Provider: Identify a reputable EOR provider with robust coverage in desired countries.

- Recruit Talent: You recruit your candidate as usual; the EOR then officially hires them through their local entity.

- Employee Management: You manage the employee’s day-to-day duties, while the EOR handles all legal and administrative employment tasks.

- Payroll and Compliance: You fund the EOR monthly, and they distribute salaries, manage local taxes, and maintain compliance.

- Support and Flexibility: EORs support ongoing employment needs, manage any HR-related issues, and facilitate seamless onboarding/offboarding.

Historical Context and Growth

The global EOR market, valued at approximately $4.5 billion in 2021, is projected to grow by 8% annually, reflecting widespread adoption by businesses navigating global expansion and remote workforce management.

Why Do Companies Use EOR Services?

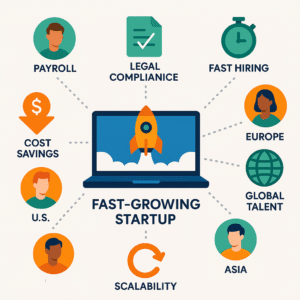

1. Rapid International Expansion

- EOR services significantly expedite global market entry compared to setting up foreign entities, reducing launch time from months to mere weeks.

2. Global Talent Acquisition

- Enables companies to legally hire skilled remote workers globally without navigating complex international employment laws independently.

3. Compliance Assurance

- Expert handling of local labor laws mitigates risk, ensuring your company remains compliant and avoiding costly legal penalties.

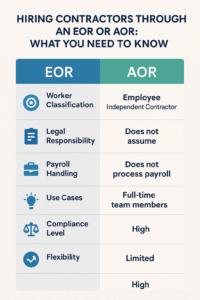

4. Avoiding Contractor Misclassification

- EOR provides a compliant employee structure, avoiding regulatory penalties from misclassifying workers as independent contractors.

5. Enhanced Focus and Efficiency

- Frees internal HR resources to focus on strategic priorities by outsourcing administrative payroll, tax, and compliance tasks.

6. Flexibility and Scalability

- Offers quick scaling up or down in response to business demands without the constraints of local entity management.

7. Cost Savings

- Eliminates significant upfront costs and ongoing administrative expenses associated with establishing and maintaining international entities.

Advantages and Considerations

Key Benefits

- Speed to Market: Dramatic reduction in time required for international market entry.

- Reduced Compliance Risk: Expert handling and liability protection for labor laws and taxation.

- Operational Efficiency: Streamlined payroll, taxes, and HR administration, boosting overall business productivity.

- Cost-Effectiveness: Significant financial savings compared to entity setup and administration.

- Scalable Solutions: Easy adaptation to fluctuating business needs and market conditions.

Potential Drawbacks

- Service Fees: EOR fees can accumulate for large-scale hiring.

- Limited Control Over Benefits: Typically less customization for employee benefit offerings.

- Employee Perception: Potential confusion or disconnect due to dual employer scenario (EOR on paper, your company operationally).

- Quality Variability: Dependence on EOR provider quality necessitates careful selection and vetting.

- Not Ideal for Permanent Large-Scale Operations: Long-term large-scale hiring might be more cost-effective with local entity setup.

Frequently Asked Questions (FAQs)

Q: Is an EOR the same as a PEO?

A: No, a PEO shares co-employment responsibilities and requires your entity’s existence, whereas an EOR assumes full employer responsibility without needing your local entity.

Q: How much do EOR services typically cost?

A: Usually a flat monthly fee ($400–$600 per employee) or a percentage of payroll. Prices vary by location and provider.

Q: Are EOR services legal?

A: Yes, reputable EOR arrangements are fully legal and commonly accepted globally.

Q: Can small businesses benefit from an EOR?

A: Absolutely, EOR solutions are ideal for businesses of all sizes, particularly helpful for smaller companies lacking extensive HR infrastructure.

Q: What differentiates an EOR from a staffing agency?

A: Staffing agencies source and recruit talent; EORs provide compliant employment and payroll administration once candidates are identified.

Recommendations for Further Improvement

- Case Studies: Incorporate real-life examples or case studies from businesses that successfully utilized EORs.

- Interactive Content: Add visual aids or infographics to enhance user engagement and understanding.

- SEO Expansion: Regularly update content with new keywords and trends related to global hiring and remote work.

Conclusion

An Employer of Record service is a strategic asset for companies seeking streamlined, compliant international hiring. By understanding its benefits, processes, and potential limitations, you can make informed decisions for effective global expansion.

Ready to simplify global hiring? Contact Divino Business Solutions for expert EOR services today.

Need help improving your hiring process? Contact Divino Solutions today for science-backed recruitment solutions or check out how to simplify recruitment or The Bias of Interviews: Are You Just Hiring a Smile?